The annual Accenture Tech Vision report is in its 25th year and continues to be a huge source of insight for our technological future. This year, AI: A Declaration of autonomy features four key trends that are set to upend the tech playing field: The Binary Big Bang, Your Face in the Future, When LLMs Get Their Bodies, and The New Learning Loop. “The New Learning Loop” is a particularly compelling trend to me for the insurance industry. This trend explores how the integration of AI can create a virtuous cycle of learning, leading, and co-creating, ultimately driving trust, adoption, and innovation. ...

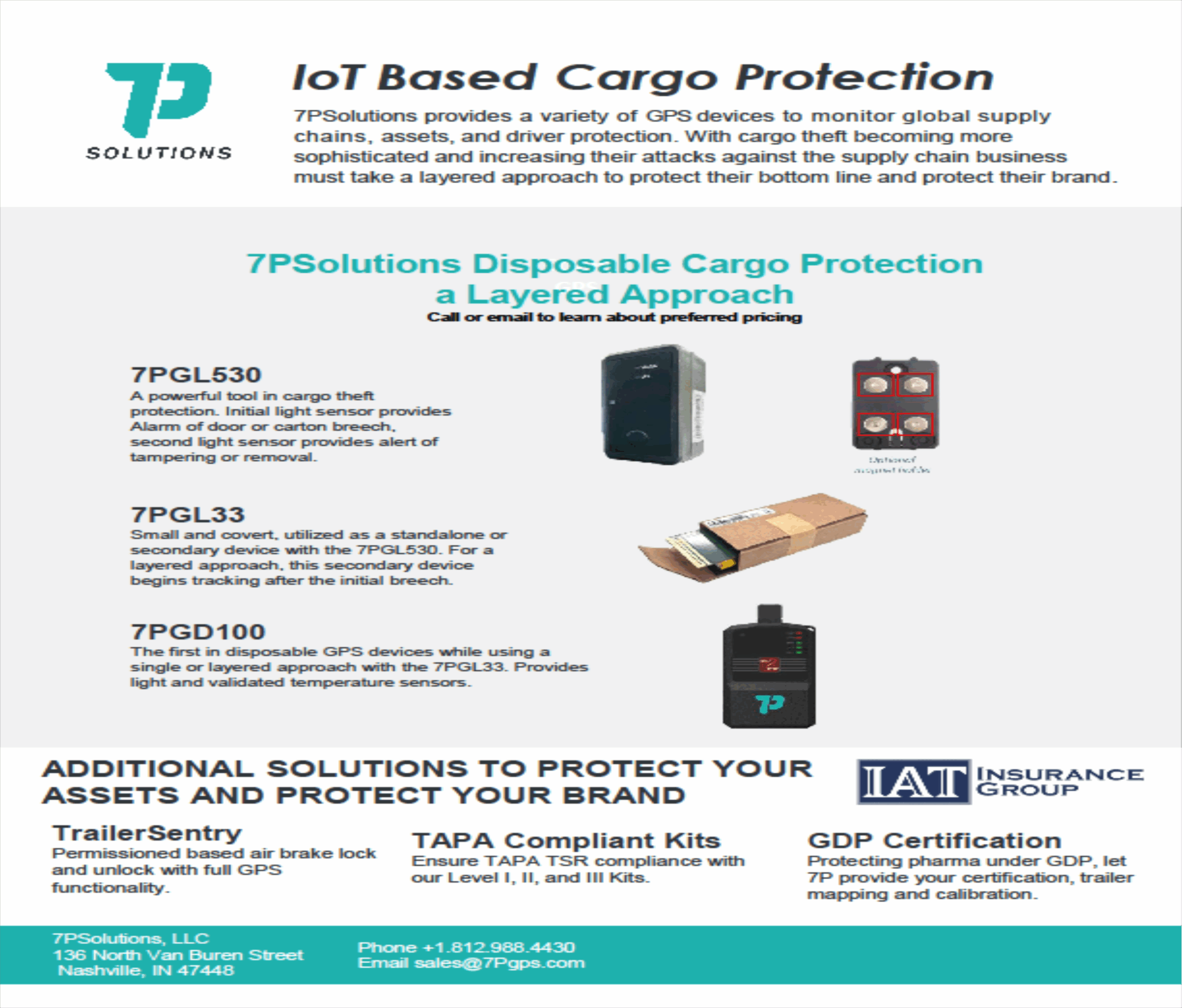

This post is part of a series sponsored by IAT Insurance Group. ...

By Loretta L. Worters, Vice President, Media Relations, Triple-I ...

The answer: it depends. While many believe that insurance is a “set-and-forget” type of investment, that isn’t always the case. Depending on your area of practice, location, and more uncontrollable factors, your insurance coverage may go “out of date” sooner than you think. That is, if you aren’t setting up a proactive legal malpractice insurance renewal. ...

In its 25th year, the annual Accenture Tech Vision report continues to be a guiding light for the future of technology. This year, the report highlights four key trends that are set to revolutionize technology: 1) The Binary Big Bang, 2) Your Face in the Future, 3) When LLMs Get Their Bodies, and 4) The New Learning Loop. Among these, “Your Face in the Future: Differentiating when every interface looks the same” stands out to me as a particularly compelling trend for the insurance industry. ...

Today’s insurance agencies rely on an average of 5.7 to 11.9 different technology platforms for day-to-day operations, depending on their total revenue. For large-scale carriers managing multiple agencies and their downstream producers, it’s likely that number is even higher. While this level of digital innovation represents a positive change in the insurance industry’s ability to offer modern experiences to its consumers and efficient workflows to its employees, cultivating a more robust tech stack doesn’t come without challenges. ...

By Lewis Nibbelin, Contributing Writer, Triple-I ...

This post is part of a series sponsored by Cotality. ...

At the Target Markets Mid-Year Conference in Dallas, we heard the same frustration over and over: ...